SDI Code (e-invoicing) - Italy

From: €0.019 + VAT

The only API to obtain the SDI Code (e-invoicing) of any Italian company, always updated and in real time.

The SDI Code (e-invoicing) is the unique code consisting of 7 characters (letters and numbers) that identifies the channel for receiving electronic invoices.

The SDI Code (e-invoicing) is the abbreviation for Sistema di Interscambio, which is the intermediary through which all electronic invoices pass and are verified before being delivered to the final recipient.

Together with the VAT number, uniquely identifies a company for electronic invoicing purposes.

The service is the only API that allows obtaining the SdI code of an Italian company updated in real-time.

The data is available from one of the following parameters:

- VAT Number

- Tax Code

- Company ID

The SDI Code (e-invoicing) service is identified by the endpoint: GET /IT-sdicode/{vatCode_taxCode_or_id}

REQUEST EXAMPLE

GET/IT-sdicode/{vatCode_taxCode_or_id}

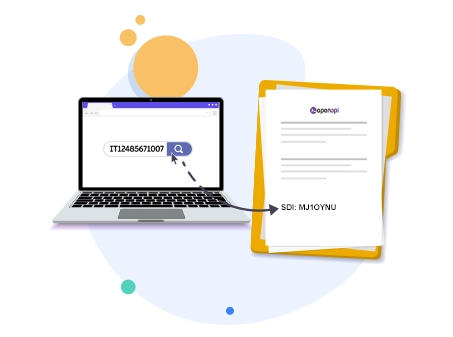

Here is an example of a request for VAT number 12485671007:

https://company.openapi.com/IT-sdicode/12485671007RESPONSE EXAMPLE

GET/IT-sdicode/{vatCode_taxCode_or_id}

The response returns the SdI code:

{

"data": [

{

"sdiCode": "MJ1OYNU",

"id": "60d1bfc731177b0a092cdfc1"

}

],

"success": true,

"message": "",

"error": null

}The response also includes the company ID, which can be used as a parameter for other Company API endpoints to obtain more detailed information about the company.

REQUEST MONITORING

Through a dedicated endpoint, it is possible to enable a monitoring service for Company services, in order to receive notifications whenever updates occur regarding the company data of interest.

By configuring a callback, the system will automatically send a notification whenever changes are detected. The frequency of checks depends on the selected service; below are some examples:

- Every 7 days for the services: IT-aml, IT-marketing, IT-stakeholders, IT-full, IT-closed, IT-vatgroup, IT-sdicode

- Every 30 days for the services: IT-ubo, EU-start, DE-start, DE-advanced, WW-TOP, IT-start, IT-advanced, IT-shareholders, IT-address, IT-pec, IT-name, FR-start, FR-advanced

The monitoring remains active for one year if the autorenew parameter is set to false

If the autorenew parameter is set to true, the service will be automatically renewed, provided that sufficient credit is available.

Do you need help?

Haven't found the answer you're looking for?

Fill in all the details, we will get back to you as soon as possible!

The service allows access to the recipient code of any Italian company via API and in real-time.

Yes, the SDI Code (e-invoicing) service is available for companies that are not registered with the Chamber of Commerce (CCIAA) but are registered with the Revenue Agency. This means that companies, individual VAT holders, or other economic entities not required to register with the CCIAA can still use the SdI service for managing electronic invoicing. However, the company must have a valid VAT number to access this service.

Yes, it is possible to activate a Company monitoring service through a dedicated endpoint, which allows you to automatically detect any updates to the company information of interest. By configuring a callback URL, the system sends an automatic notification whenever changes are detected, without the need for manual checks.

The frequency of checks depends on the monitored service:

Every 7 days for the following services: IT-aml, IT-marketing, IT-stakeholders, IT-full, IT-closed, IT-vatgroup, IT-sdicode

Every 30 days for the following services: IT-ubo, EU-start, DE-start, DE-advanced, WW-TOP, IT-start, IT-advanced, IT-shareholders, IT-address, IT-pec, IT-name, FR-start, FR-advanced

The monitoring service has a duration of one year.

If the autorenew parameter is set to false, the service ends at the annual expiration; if set to true, the monitoring service is automatically renewed, provided that sufficient credit is available.

The SDI Code (e-invoicing) product is ideal for companies, software houses, and accountants managing large volumes of electronic invoicing and needing to automate and keep up-to-date the collection and management of recipient codes for Italian companies. It is also useful for SaaS providers that integrate electronic invoicing solutions and need to quickly and securely connect to company data via API.

The service guarantees real-time access to data, offering immediate availability of requested information. This means that as soon as a request is submitted, the system processes and provides the data within moments, ensuring a continuous and rapid flow of information without prolonged waiting times.

The cost for each individual request via recharge is €0.03 + VAT.