European VAT Check

From: €0.014 + VAT

Verify in real time the existence and access basic information of any European company using the VAT and through API.

European VAT Check is the service that allows you to obtain information about a European company based on the VAT number.

The VAT (Value-Added Tax) is the unique identification number of a company within the European Union, and in Italy, it corresponds to the VAT number preceded by the country code (IT). It is necessary for companies engaging in B2B transactions and facilitates cross-border economic activities within the EU.

The European VAT Check service allows you to verify in real-time whether a company's VAT number is registered and operating within the European Union.

Information about the validity of the VAT registration number is available for all current 27 EU member states, including companies not registered in VIES.

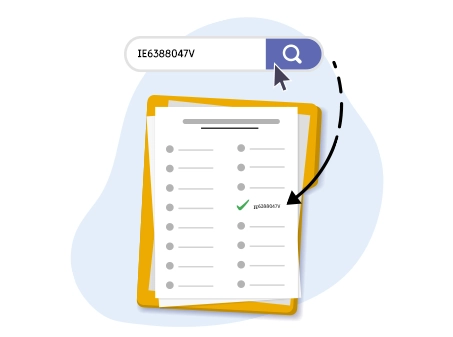

REQUEST EXAMPLE

In the following request, we use the VAT number as a parameter: IE6388047V

GET https://company.openapi.com/EU-start/IE6388047V RESPONSE EXAMPLE

The information returned in the response includes:

- VAT Number Validity Check

- Company Name

- Registered Address

{

"data": {

"valid": true,

"formatValid": true,

"countryCode": "IE",

"vatCode": "6388047V",

"companyName": "GOOGLE IRELAND LIMITED",

"companyAddress": "3RD FLOOR, GORDON HOUSE, BARROW STREET, DUBLIN 4"

},

"success": true,

"message": "",

"error": null

}

The service is often used to verify a customer's VAT and determine whether to charge taxes on a potential transaction.

Due to data protection, some national authorities may not make the name and address corresponding to a VAT number available. In such cases, the API will only confirm whether a specific VAT number is valid or not and will not be able to provide information on company name and registered address.

Do you need help?

Haven't found the answer you're looking for?

Fill in all the details, we will get back to you as soon as possible!

It is the unique identifying number of a company within the EU, used for B2B transactions to facilitate cross-border economic activities between companies in the EU.

The European VAT Check service allows you to verify the validity of the VAT number of a company within the European Union. This tool is particularly useful for businesses and professionals operating internationally, as it ensures that the VAT numbers provided by business partners or clients are correct and active. In addition to ensuring tax compliance, the service helps avoid issues related to invalid or irregular intra-community transactions, improving the security of business transactions.

The information returned in the response includes:

- Company name

- Registered office

- VAT validity

Due to data protection regulations, some national authorities may not make the name and address corresponding to a VAT number available. In this case, the API will only confirm whether a given VAT number is valid or not and will not be able to provide information on the company name and registered office.

Yes, for all 27 member states.

In the event that complete company information is not available, the system will still return the validity of the VAT number. This ensures that, even in the absence of detailed company data, it is still possible to verify the activation and regularity of the VAT number, providing essential information for further checks or evaluations.

The European VAT Check service is designed for a wide range of users operating in various sectors who need reliable tools to manage their international tax transactions:

- B2B companies: To verify the validity of their business partners' VAT numbers and ensure secure and compliant transactions with European regulations.

- E-commerce: Managing cross-border sales and needing to correctly handle VAT for different jurisdictions within the EU.

- Accountants: Assisting companies in managing tax practices and needing reliable tools for European VAT verification.

- Start-ups and SMEs (Small and Medium Enterprises): Looking to expand into other EU member countries and needing tools to facilitate intra-community operations.

- Importers and Exporters: Conducting international trade and needing to ensure tax compliance in their transactions.

- Financial and Administrative Departments: Within companies that manage accounting and need tools for VAT verification and management.

- Legal Professionals: Requiring accurate and up-to-date information to ensure regulatory compliance for their activities and clients.

- Developers and IT Integrations: Looking to integrate European VAT Check verification into their systems via API to automate and streamline business processes.

Using this service improves operational efficiency, reduces the risk of tax errors, and ensures compliance with European VAT regulations, facilitating cross-border business activities within the EU.

The service provides an immediate response via API. This means that once the request is submitted, the data is processed and returned in real-time, allowing the requested information to be obtained within moments. This approach is particularly useful for those who need quick answers for business decisions, checks, or other operational activities that require timeliness.

The cost of the European VAT Check service for each individual request via recharge is €0.02 + VAT.